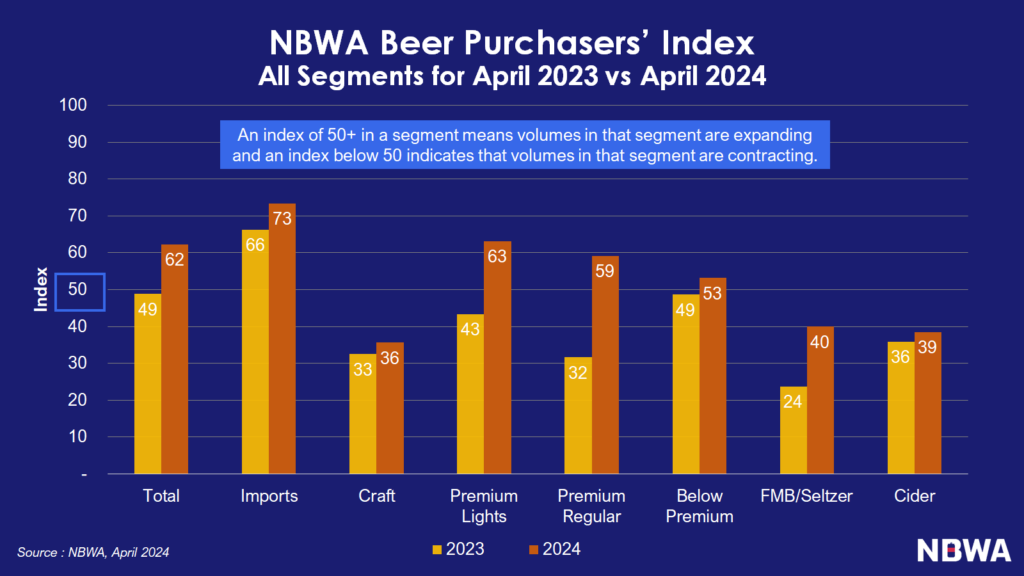

Summer is approaching, and beer purchasing activity is still on an incline, according to the National Beer Wholesalers Association’s (NBWA) April 2024 Beer Purchasers’ Index (BPI). The April BPI reading – 61 – is the highest reading, and first at 60 or higher, since December 2021. A BPI reading of 50+ indicates that purchasing volumes are expanding in that segment, while a reading of below 50 shows that volumes in that segment are contracting.

About the BPI

The BPI is compiled by Lester Jones, NBWA Vice President, Analytics and Chief Economist, and is an “informal monthly statistical release giving distributors a timely and reliable indicator of beer purchasing activity.” It is similar to the Purchasing Managers’ Index (PMI), which highlights economic trends in the manufacturing and services sectors, the only difference being that the BPI focuses exclusively on beer.

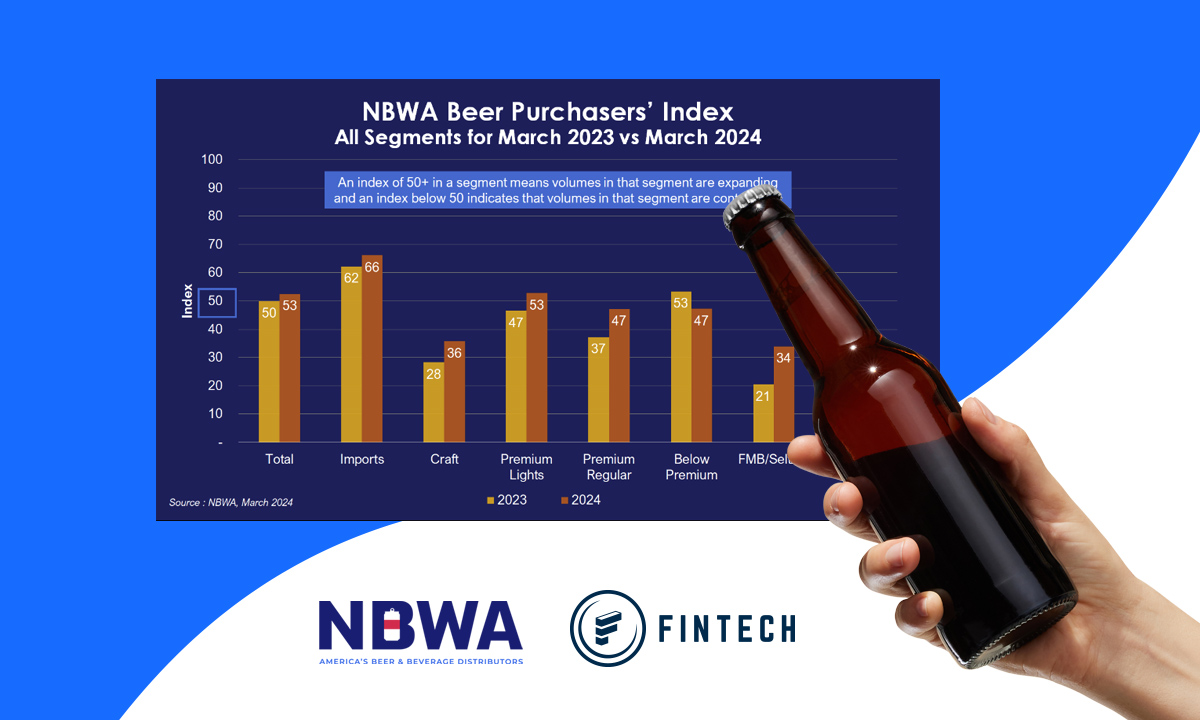

How? By aggregating beer distributors’ purchases across seven different segments – Imports, Craft, Premium Lights, Premium Regular, Below Premium, FMB/Seltzer, and Cider – and comparing it to last year’s data. BPI is the only forward-looking report to assess expected beer demand (one month forward).

Beer Growth Across All Segments

The latest BPI shows recorded year-over-year (YoY) growth across all seven segments. The two segments with the highest growth were Premium Regular, with a 27-point jump, and Premium Lights, with a 20-point jump. NBWA reported that this is the first time that both the BPI metric and all seven measured segments have increased in the same month since March 2021.

Imports are by far the leading segment at 73. Premium Lights and Premium Regular are the next two strongest categories. Even the three contracting categories – Craft, FMB/Seltzer, and Cider – are showing positive growth compared to last year’s readings. The overall strong segment growth bodes well for beer ordering across the nation as the busy summer season nears.

Prep for Increased Beer Sales Volume With NBWA and Fintech

Strong beer market growth is a good sign for distributors and alcohol businesses alike. More beer-purchasing activity means fulfilling more orders across all accounts. Alcohol distributors can prepare for the busy summer season with Fintech. Fintech’s Distributor Toolkit is packed with helpful resources to onboard new retailers and promote electronic funds transfer (EFT) payments for all beer invoices. With automated EFT payments, drivers can save up to 15 minutes per stop, allowing them to deliver more beer throughout the day.

Distributors can also join NBWA to gain exclusive access to industry insights, resources, and programs. There are opportunities to connect with distribution leaders and other beer and beverage industry members at in-person events, as well as additional digital support opportunities.

With Fintech, NBWA, and purchasing insights from the BPI, beer distributors position themselves to drive more success in the beer market.